The MyRec.com system offers many ways to help you balance accounts and rectify your bank account to your income statements. Here are a few of the ways to keep an eye on your accounts, so that issues can be dealt with sooner rather than later.

Budget Groups

The MyRec.com system allows for the creation of budget groups that can be assigned to revenues and expenses. It is advisable to create these based on your agency’s General Ledger account codes if they are established.

Once created these Budget Groups can be assigned to each item (i.e. rental, POS or activity)

This helps your reporting to be more detailed and makes disbursements easier to track.

Financial Reporting

Running reports on a consistent basis is a good practice.

Daily Checklist

- Check for Invoice Issues

- Run an Income Summary Report and balance your cash drawer

- Check the Payment Subscription Report if applicable

- Check credit card gateway settled transactions report

Month End Checklist

- Run an Income Summary Report (compare to bank deposits for cash and checks)

- Run a Disbursement Summary Report to compare to Income Summary Report. Did it balance?

- Run a Monthly Statement from your credit card gateway –compare to fees withdrawn from bank

- Run a Monthly Statement from your credit processor

- Compare to fees withdrawn from bank and deposits an Adjustment History Report if you need to report discounts on a monthly basis

- Run an Income Summary Report daily

- This report can be used to balance your cash till, rectify your daily bank deposit and alert you to potential invoice problems

- Should also be run when registration shifts change within the day to alert to cash drawer imbalances

Do not ignore the Invoice Issues yellow bar on your home screen. This is alerting you to issues that will not rectify themselves without your intervention.

At the end of each month run the following reports for financial balancing: Income Summary Report, Disbursement Summary Report, Authorize.net or your gateway monthly statement for finding gateway fees that are taken out of the bank account and Priority Payment or your credit card processors monthly statement report.

- This shows when the credit cards were sent to the bank and the associated fees that are charged for the use of credit cards.

If you use subscriptions or recurring payments, you should run the Payment Subscription report and the Authorize.net Settled Transactions report daily.

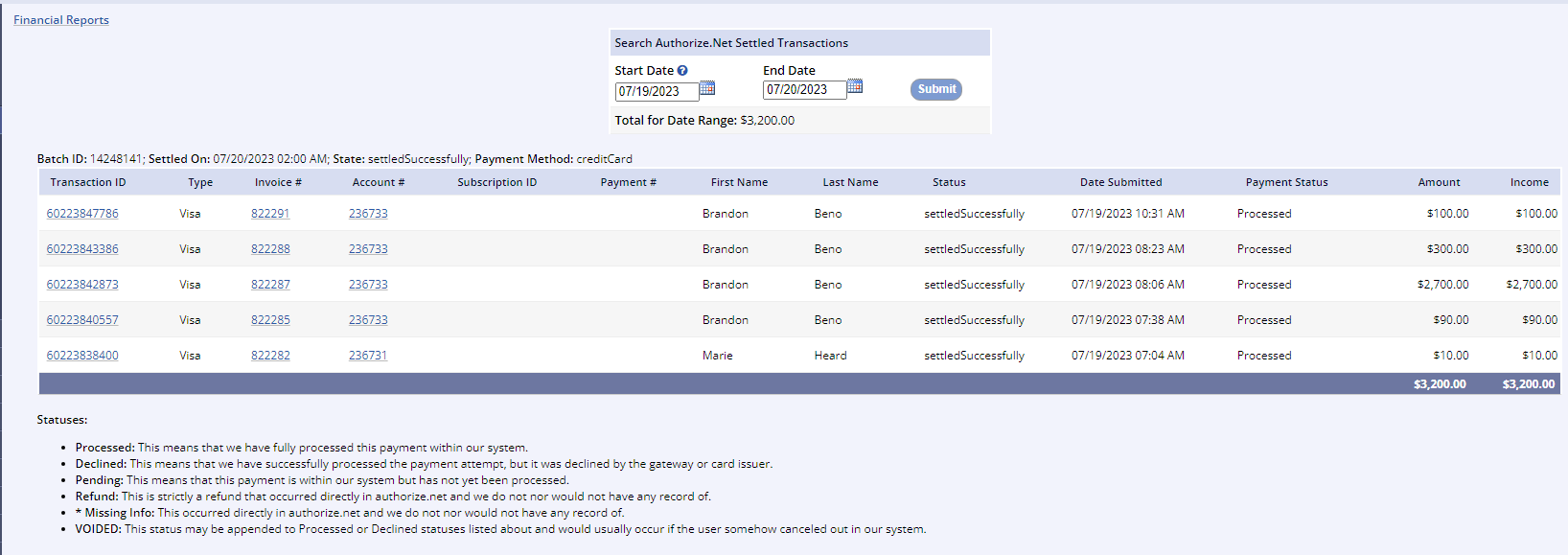

Authorize.net Reports – Settled Transactions

This report shows the settled credit card transactions for a date range (found under Reports> Financial Reports> Authorize.net reports>Settled Transactions). If you do not see these reports and are using Authorize.net, contact MyRec.com for directions to turn them on.

Note that you can bring up the transaction detail by clicking on the Transaction ID. Clicking on the Invoice # will bring you to the Invoice screen in the account and clicking the account number will bring you directly to the account.

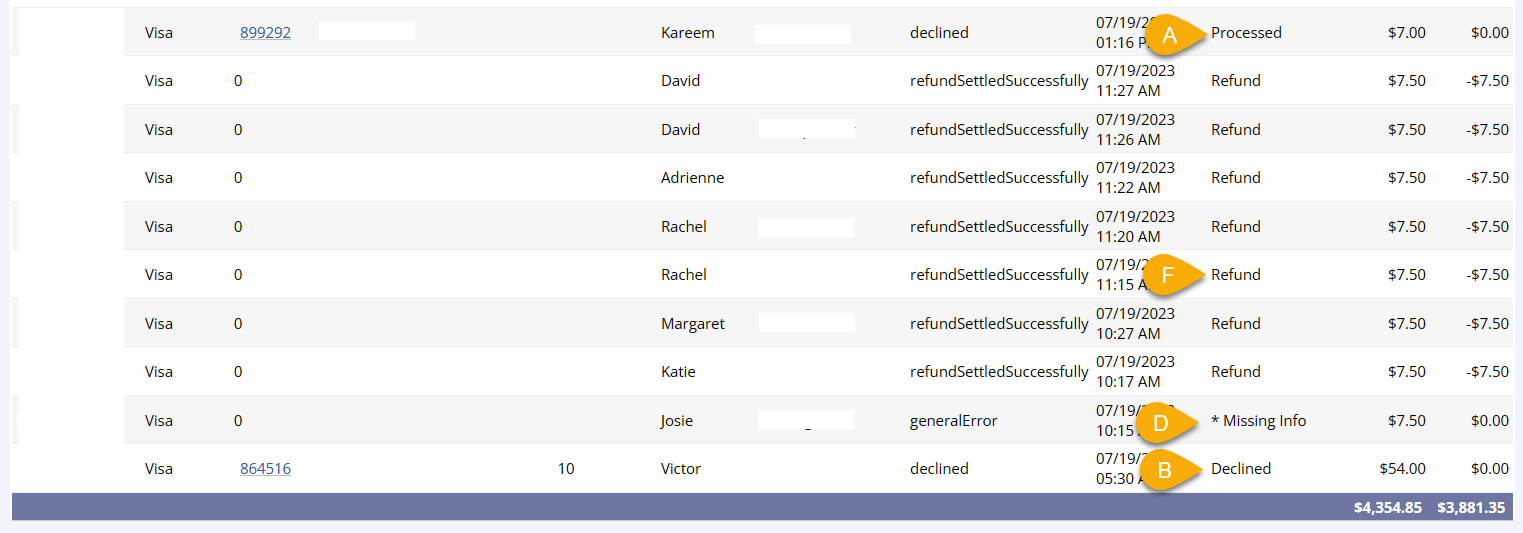

There are many different payment statuses that may show up in the report.

Statuses

- Processed

- This means that we have fully processed this payment within our system

- Declined

- This means that we have successfully processed the payment attempt, but it was declined by the gateway or card issuer

- Pending

- This means that this payment is within our system but has not yet been processed

- * Missing Info

- This occurred directly in authorize.net and we do not nor would not have any record of

- Voided

- This status may be appended to Processed or Declined statuses listed about and would usually occur if the user somehow canceled out in our system

- Refund

- This is strictly a refund that occurred directly in authorize.net and we do not nor would not have any record of

*Personal information in this screenshot has been omitted intentionally

These types of payment statuses happen infrequently but require management action for the payment to be recognized in the MyRec.com system. If they are not corrected it will leave the account looking as though there is a balance owed.

Payment Subscription Report

This report (found under Reports > Financial Reports > Other Reports) shows the success or failure of recurring payments for a date range.

It will also show those subscriptions with credit cards that are about to expire.

Expired cards and declined subscription payments will require action to apply a payment and/or update the payment card.

Miscellaneous

Many departments do not accept American Express (Amex) or Discover (Disc) credit cards. If that is the case with your department, we recommend that you include that verbiage on your site to avoid customers attempting to use the card and experiencing delays in completing their registrations or purchases as it is not an acceptable payment type.

If you have questions regarding customer chargebacks, you will want to contact your payment processing gateway to find out more information. If you need to connect with MyRec.com, please reach out to us at support@myrec.com with the details you have gathered from the customer and processor. Your department may consider EMV options to reduce chargebacks from customers.